The Ultimate Guide To Making Extra Income On The Side By Trading Covered Calls

Are you looking for ways to make extra income on the side? If so, trading covered calls is a great option. It is a relatively low-risk strategy that can be used to generate income from stocks that you already own. In this guide, we will discuss everything you need to know about trading covered calls, from the basics to more advanced strategies. We will also provide some tips to help you get started.

A covered call is a type of options strategy that involves selling a call option while simultaneously owning the underlying security. When you sell a call option, you are giving someone else the right to buy your stock at a certain price (the strike price) on or before a certain date (the expiration date). In return for selling the call option, you receive a premium.

For example, let's say you own 100 shares of Apple stock, and the current stock price is $100. You could sell a call option with a strike price of $105 and an expiration date of one month from now. If the stock price rises above $105 before the expiration date, the buyer of the call option will exercise their right to buy your stock at $105. You will then be obligated to sell them your stock at that price.

4.4 out of 5

| Language | : | English |

| File size | : | 9406 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 509 pages |

| Lending | : | Enabled |

If the stock price does not rise above $105 before the expiration date, the call option will expire worthless, and you will keep the premium that you received for selling it.

There are several benefits to trading covered calls, including:

- Potential for income generation: Covered calls can be used to generate income from stocks that you already own. This can be a great way to supplement your regular income or to save for a specific goal.

- Relatively low risk: Covered calls are a relatively low-risk strategy because you are always protected by the fact that you own the underlying security. This means that you cannot lose more money than the amount that you invested in the stock.

- Flexible: Covered calls can be used to generate income from stocks that are either rising or falling in price. This makes them a versatile strategy that can be adapted to different market conditions.

While covered calls are a relatively low-risk strategy, there are still some risks involved. These risks include:

- Loss of upside potential: If the stock price rises significantly above the strike price of the call option, you will be obligated to sell your stock at the strike price. This means that you will miss out on the potential profits that could have been made by holding onto the stock.

- Stock price decline: If the stock price declines, you could lose money on the sale of the call option. This is because the premium that you receive for selling the call option will be less than the amount that you lose on the sale of the stock.

- Margin calls: If you are using margin to trade covered calls, you could be subject to a margin call if the stock price declines significantly. This means that you would be required to deposit additional funds into your account to cover the losses.

To trade covered calls, you will need to have a brokerage account that allows you to trade options. You will also need to have a basic understanding of options trading.

Once you have a brokerage account and a basic understanding of options trading, you can follow these steps to trade covered calls:

- Identify a stock that you want to trade. The stock should be one that you are familiar with and that you believe has the potential to rise in price.

- Purchase the stock. You will need to purchase enough shares of the stock to cover the number of call options that you want to sell.

- Sell a call option. Once you have purchased the stock, you can sell a call option against it. The strike price of the call option should be above the current stock price, and the expiration date should be far enough out that you have time to profit from the sale of the call option.

- Monitor the stock price. Once you have sold a call option, you will need to monitor the stock price to see if it rises above the strike price. If the stock price rises above the strike price, you will be obligated to sell your stock at the strike price.

Here are a few tips to help you get started with trading covered calls:

- Start small. When you are first starting out, it is best to start small. This will help you to minimize your risk and to learn the ropes of trading covered calls.

- Choose stocks that you know. The stocks that you trade covered calls on should be stocks that you are familiar with and that you believe have the potential to rise in price.

- Sell call options with a strike price that is above the current stock price. This will help you to maximize your potential profits.

- Sell call options with an expiration date that is far enough out. This will give you time to profit from the sale of the call option.

- Monitor the stock price regularly. This will help you to stay on top of the market and to make informed decisions about when to sell your call options.

Trading covered calls is a great way to make extra income on the side. It is a relatively low-risk strategy that can be used to generate income from stocks that you already own. If you are looking for a way to supplement your regular income or to save for a specific goal, trading covered calls is a great option.

4.4 out of 5

| Language | : | English |

| File size | : | 9406 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 509 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare James W Hall

James W Hall Hans Hermann Hoppe

Hans Hermann Hoppe Jim Koch

Jim Koch Vangeline

Vangeline Donald J Trump

Donald J Trump Chip Bishop

Chip Bishop Catherine Gray

Catherine Gray Lenora Mattingly Weber

Lenora Mattingly Weber Danielle Roberts

Danielle Roberts Bounchoeurn Sao

Bounchoeurn Sao Tricia Tunstall

Tricia Tunstall Timothy Scott

Timothy Scott June Wood

June Wood James Laxer

James Laxer Jeffrey A Robinson

Jeffrey A Robinson Sean V Bradley

Sean V Bradley Tom Lewis

Tom Lewis Linda Gartz

Linda Gartz Marshall Goldsmith

Marshall Goldsmith Scott J Bintz

Scott J Bintz

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Roald DahlDiscover Insider Secrets: Unleash Your Potential in Interviewing for Big Tech...

Roald DahlDiscover Insider Secrets: Unleash Your Potential in Interviewing for Big Tech...

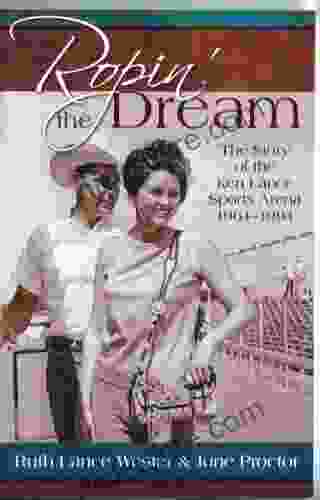

Darrell PowellRopin' the Dream: Ruth Lance Wester, A Cowgirl Who Defied Barriers and Soared...

Darrell PowellRopin' the Dream: Ruth Lance Wester, A Cowgirl Who Defied Barriers and Soared... Scott ParkerFollow ·8.7k

Scott ParkerFollow ·8.7k Michael SimmonsFollow ·16.1k

Michael SimmonsFollow ·16.1k Jamison CoxFollow ·4.7k

Jamison CoxFollow ·4.7k Shawn ReedFollow ·2.6k

Shawn ReedFollow ·2.6k Dawson ReedFollow ·14.8k

Dawson ReedFollow ·14.8k David BaldacciFollow ·7.4k

David BaldacciFollow ·7.4k Dylan HayesFollow ·16.6k

Dylan HayesFollow ·16.6k Isaiah PriceFollow ·7.4k

Isaiah PriceFollow ·7.4k

Edwin Blair

Edwin BlairKilling A King: The Assassination Of Yitzhak Rabin And...

## The Assassination Of Yitzhak Rabin And The...

Carlos Fuentes

Carlos FuentesDeath in Benin: Where Science Meets Voodoo

In the West African nation of Benin, death...

Ernest J. Gaines

Ernest J. GainesA Comprehensive Guide to Managing Your Girlfriend's White...

White guilt, a complex and...

Jon Reed

Jon ReedThe Notorious Life and Times of Pablo Escobar, the...

Pablo Escobar, the...

Juan Rulfo

Juan RulfoTrainwreck: My Life As An Idiot

My life has been a trainwreck. I've made...

Christian Barnes

Christian BarnesFirst Words Childhood In Fascist Italy: A Haunting Memoir...

First Words Childhood In...

4.4 out of 5

| Language | : | English |

| File size | : | 9406 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 509 pages |

| Lending | : | Enabled |