The First Inside Account of Venture Capitalists at Work

Venture capitalists, often hailed as the financial gatekeepers of innovation, play a pivotal role in fostering the growth of start-ups and shaping the tech industry landscape. However, despite their immense influence, the inner workings of the venture capital industry have remained shrouded in secrecy, leaving many outsiders wondering about the strategies, motivations, and decision-making processes that drive these influential investors.

4.4 out of 5

| Language | : | English |

| File size | : | 1316 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 352 pages |

In a groundbreaking book titled "Venture Capital: The Inside Account," the first of its kind, author and experienced venture capitalist Paul Kedrosky pulls back the curtain on the venture capital world, providing an insightful and comprehensive account of the industry's inner workings. Through extensive interviews with prominent venture capitalists, Kedrosky unravels the complex dynamics and decision-making processes that shape investment decisions, offering a rare glimpse into the minds of these influential figures.

In this article, we delve into Kedrosky's illuminating work, exploring the key insights and revelations that shed light on the fascinating world of venture capitalists at work.

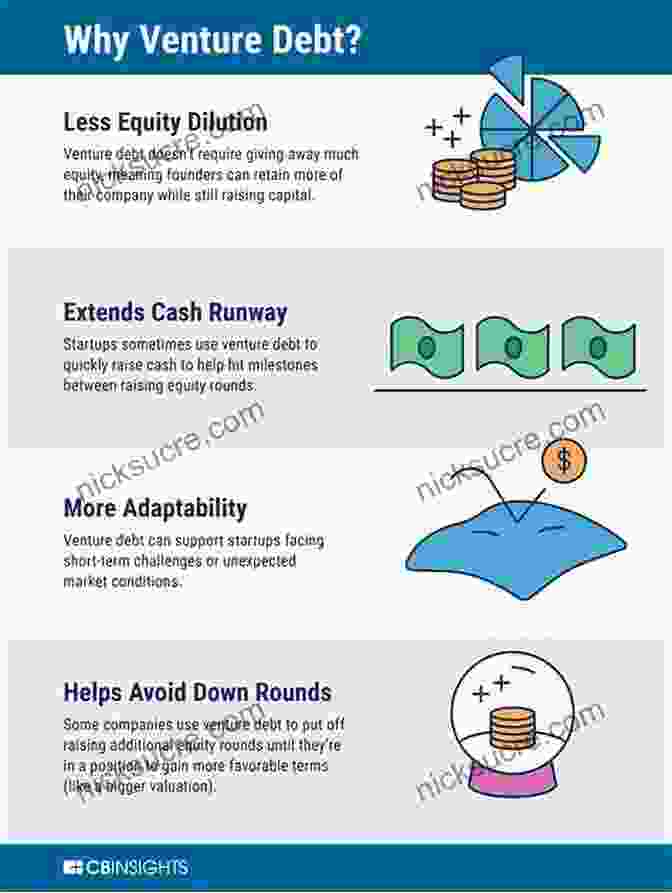

Understanding Venture Capital: A Balancing Act

At the heart of venture capital lies a delicate balancing act between risk and reward. Venture capitalists invest in early-stage start-ups with the potential for exponential growth, but these investments often come with a high degree of risk. Kedrosky highlights the unique challenges that venture capitalists face in assessing the potential of start-ups, often relying on limited data and a blend of intuition and experience.

The book emphasizes the importance of pattern recognition in the venture capital world. Seasoned venture capitalists draw upon their knowledge and experience to identify promising start-ups that exhibit patterns similar to those of successful past investments. They seek out start-ups with strong teams, innovative ideas, and a clear market opportunity, but they also recognize that even the most promising investments can fail.

The Psychology of Venture Capitalists: Risk-Takers and Pattern Seekers

Venture capitalists are not merely analytical investors; they are also driven by a unique psychological profile that shapes their decision-making. Kedrosky delves into the minds of venture capitalists, exploring their motivations, biases, and risk tolerance.

He reveals that venture capitalists are often drawn to the thrill of the chase, seeking out the next big opportunity that could yield extraordinary returns. They are willing to take calculated risks, but they also understand the importance of managing that risk through diversification and a disciplined investment approach.

Furthermore, venture capitalists exhibit a strong pattern-seeking mentality. They are constantly searching for patterns in start-ups and industries, hoping to identify those that resemble the characteristics of past successes. This pattern recognition ability allows them to make informed decisions in the face of uncertainty.

The Investment Process: Due Diligence, Deal Flow, and Exit Strategies

Kedrosky provides a detailed overview of the investment process followed by venture capitalists, highlighting the importance of due diligence, deal flow, and exit strategies.

Due diligence is a critical stage in the investment process, where venture capitalists thoroughly evaluate the potential of a start-up. They scrutinize the team, market opportunity, financial projections, and competitive landscape to assess the investment's risk and potential return.

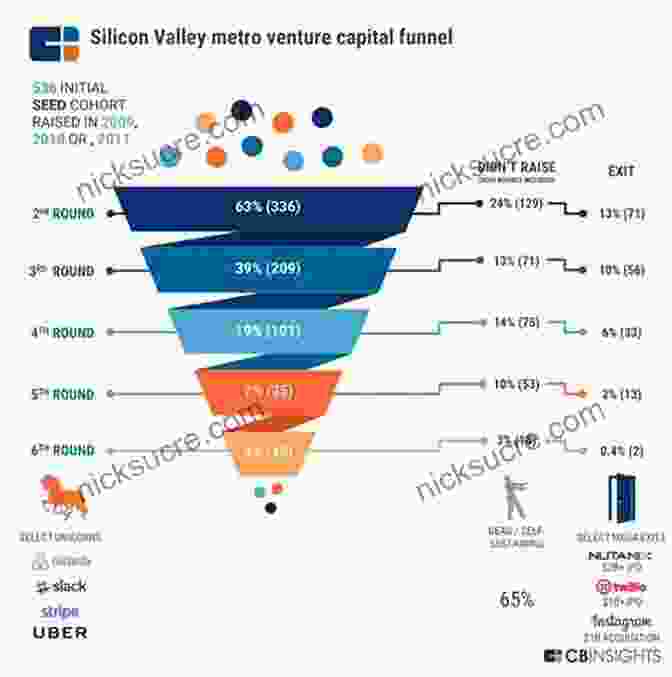

Deal flow refers to the process of identifying and screening potential investments. Venture capitalists employ a variety of methods to generate deal flow, including attending industry events, networking with entrepreneurs, and working with incubators and accelerators.

Exit strategies play a vital role in the venture capital investment cycle. Venture capitalists typically aim to exit their investments within a certain time frame, either through an initial public offering (IPO),acquisition, or secondary sale. The choice of exit strategy depends on various factors, including market conditions, company performance, and investor preferences.

The Value-Add of Venture Capitalists: Beyond Financial Investment

While venture capitalists primarily provide financial backing to start-ups, their role extends far beyond mere investment. They often take an active role in mentoring and supporting the companies they invest in, offering strategic advice, industry connections, and operational expertise.

Kedrosky highlights the value-add that venture capitalists can bring to start-ups, particularly in areas such as business development, fundraising, and talent acquisition. They can help entrepreneurs navigate the complexities of running a start-up and provide access to resources and networks that would otherwise be difficult to obtain.

The Challenges and Controversies of Venture Capital

The venture capital industry is not without its challenges and controversies. Kedrosky addresses some of the criticisms that have been leveled against venture capitalists, including their focus on short-term returns, their tendency to favor certain types of start-ups and industries, and their influence on the broader tech ecosystem.

He acknowledges that venture capital is not a perfect system and that it can sometimes lead to unintended consequences. However, he also argues that the industry plays a vital role in funding innovation and promoting economic growth, and that its benefits often outweigh its drawbacks.

"Venture Capital: The Inside Account" by Paul Kedrosky is an indispensable resource for anyone seeking to understand the inner workings of the venture capital industry. Through his insightful account, Kedrosky demystifies the decision-making processes of venture capitalists, revealing the strategies, motivations, and challenges that shape their investment decisions.

This book provides a unique glimpse into the world of these influential investors, offering valuable insights and lessons for start-ups, investors, and anyone involved in the tech ecosystem. As the venture capital industry continues to evolve, Kedrosky's work serves as a valuable reference point for understanding the complexities and dynamics of this fascinating field.

4.4 out of 5

| Language | : | English |

| File size | : | 1316 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 352 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Richard Meadows

Richard Meadows Tracy Borman

Tracy Borman Jonathan Tolins

Jonathan Tolins Danny Stock

Danny Stock Mike Konczal

Mike Konczal Sheryl Ness

Sheryl Ness Harvey Fierstein

Harvey Fierstein Ellyn Gaydos

Ellyn Gaydos Breaking The Silence

Breaking The Silence Lateisha Johnson

Lateisha Johnson Roger Lowenstein

Roger Lowenstein Sharada Dwivedi

Sharada Dwivedi Deirdre Finnerty

Deirdre Finnerty Robert Leckie

Robert Leckie Pam Fessler

Pam Fessler Daniel J Crooks

Daniel J Crooks Magnus Penker

Magnus Penker Susan F Hirsch

Susan F Hirsch William Schumann

William Schumann Jessi Park

Jessi Park

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Virginia WoolfAnd Other Tips And Truths About Aging: Unveiling the Secrets of Graceful...

Virginia WoolfAnd Other Tips And Truths About Aging: Unveiling the Secrets of Graceful...

Felix CarterThe Astonishing Life of August March: A Literary Masterpiece Unveiling the...

Felix CarterThe Astonishing Life of August March: A Literary Masterpiece Unveiling the... Dalton FosterFollow ·5.8k

Dalton FosterFollow ·5.8k William ShakespeareFollow ·18.9k

William ShakespeareFollow ·18.9k Felix CarterFollow ·3.7k

Felix CarterFollow ·3.7k Al FosterFollow ·19.2k

Al FosterFollow ·19.2k Mario Vargas LlosaFollow ·6.1k

Mario Vargas LlosaFollow ·6.1k Oliver FosterFollow ·7.1k

Oliver FosterFollow ·7.1k Gil TurnerFollow ·6.5k

Gil TurnerFollow ·6.5k Gilbert CoxFollow ·7.2k

Gilbert CoxFollow ·7.2k

Edwin Blair

Edwin BlairKilling A King: The Assassination Of Yitzhak Rabin And...

## The Assassination Of Yitzhak Rabin And The...

Carlos Fuentes

Carlos FuentesDeath in Benin: Where Science Meets Voodoo

In the West African nation of Benin, death...

Ernest J. Gaines

Ernest J. GainesA Comprehensive Guide to Managing Your Girlfriend's White...

White guilt, a complex and...

Jon Reed

Jon ReedThe Notorious Life and Times of Pablo Escobar, the...

Pablo Escobar, the...

Juan Rulfo

Juan RulfoTrainwreck: My Life As An Idiot

My life has been a trainwreck. I've made...

Christian Barnes

Christian BarnesFirst Words Childhood In Fascist Italy: A Haunting Memoir...

First Words Childhood In...

4.4 out of 5

| Language | : | English |

| File size | : | 1316 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 352 pages |