The Case for the Return of the 100% Gold Standard Dollar

In the wake of the recent global financial crisis, the world has been forced to re-evaluate its economic system. One of the most important questions being asked is whether or not we should return to a gold standard, which would require that the value of the dollar be pegged to the price of gold.

There are many arguments in favor of a gold standard. Proponents claim that it would provide stability to the economy, reduce inflation, and help to prevent financial crises. They also argue that it would help to protect the value of the dollar against foreign currency fluctuations.

4.2 out of 5

| Language | : | English |

| File size | : | 225 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 75 pages |

| Lending | : | Enabled |

However, there are also some arguments against a gold standard. Opponents claim that it would be inflexible and could stifle economic growth. They also argue that it would be difficult to implement and could lead to deflation.

In this article, we will explore the arguments for and against a gold standard dollar, and we will try to determine whether or not it is a good idea for the United States to adopt such a system.

The History of the Gold Standard

The gold standard is a monetary system in which the value of a country's currency is pegged to the price of gold. This means that the government agrees to buy and sell gold at a fixed price, and that the currency can be redeemed for gold at that price.

The gold standard has been used for centuries, and it was the dominant monetary system in the world from the 18th to the early 20th centuries. However, the gold standard was abandoned by most countries in the 1930s, during the Great Depression.

Since then, the value of the dollar has been determined by a fiat system, which is a system in which the currency is not backed by any physical commodity. Under a fiat system, the government can simply print more money if it wants to, which can lead to inflation.

The Arguments for a Gold Standard

There are many arguments in favor of a gold standard. Proponents claim that it would:

* Provide stability to the economy. A gold standard would help to stabilize the economy by providing a fixed value for the dollar. This would make it easier for businesses to plan for the future and would help to reduce economic volatility.

* Reduce inflation. A gold standard would help to reduce inflation by making it more difficult for the government to print money. This is because the government would have to purchase gold from the market if it wanted to print more money, and this would increase the price of gold.

* Help to prevent financial crises. A gold standard would help to prevent financial crises by making it more difficult for banks and other financial institutions to create excessive debt. This is because banks would have to hold more gold in reserve if they wanted to borrow more money.

* Protect the value of the dollar against foreign currency fluctuations. A gold standard would help to protect the value of the dollar against foreign currency fluctuations. This is because the price of gold is determined by supply and demand, and it is not affected by the actions of any government.

The Arguments Against a Gold Standard

There are also some arguments against a gold standard. Opponents claim that it would:

* Be inflexible. A gold standard would be inflexible and could stifle economic growth. This is because the government would not be able to change the value of the dollar in response to changing economic conditions.

* Difficult to implement. A gold standard would be difficult to implement, especially in a globalized economy. This is because it would require the cooperation of all of the major countries in the world.

* Lead to deflation. A gold standard could lead to deflation, which is a sustained decrease in the general price level. This is because the government would not be able to print more money to stimulate the economy if it was necessary.

The Case for a 100% Gold Standard Dollar

The United States has not had a true gold standard since 1933. However, there is a growing movement to return to a gold standard system. Proponents of a gold standard argue that the benefits outweigh the costs, and that it is the best way to protect the value of the dollar and ensure the long-term health of the economy.

A 100% gold standard dollar would be a currency that is backed by gold. This means that the government would agree to buy and sell gold at a fixed price, and that the currency could be redeemed for gold at that price.

There are many arguments in favor of a 100% gold standard dollar. Proponents claim that it would:

* Provide stability to the economy. A gold standard would help to stabilize the economy by providing a fixed value for the dollar. This would make it easier for businesses to plan for the future and would help to reduce economic volatility.

* Reduce inflation. A gold standard would help to reduce inflation by making it more difficult for the government to print money. This is because the government would have to purchase gold from the market if it wanted to print more money, and this would increase the price of gold.

* Help to prevent financial crises. A gold standard would help to prevent financial crises by making it more difficult for banks and other financial institutions to create excessive debt. This is because banks would have to hold more gold in reserve if they wanted to borrow more money.

* Protect the value of the dollar against foreign currency fluctuations. A gold standard would help to protect the value of the dollar against foreign currency fluctuations. This is because the price of gold is determined by supply and demand, and it is not affected by the actions of any government.

* Encourage savings. A gold standard would encourage savings by making it more attractive to hold gold. This is because gold is a store of value that cannot be inflated away by the government.

* Reduce government debt. A gold standard would help to reduce government debt by making it more difficult for the government to borrow money. This is because the government would have to purchase gold from the market if it wanted to borrow more money, and this would increase the price of gold.

The case for a 100% gold standard dollar is strong. A gold standard would provide stability to the economy, reduce inflation, help to prevent financial crises, protect the value of the dollar against foreign currency fluctuations, encourage savings, and reduce government debt.

The decision of whether or not to return to a gold standard is a complex one. There are many factors to consider, and there is no easy answer. However, the case for a 100% gold standard dollar is strong. A gold standard would provide many benefits to the United States, and it is something that should be seriously considered.

4.2 out of 5

| Language | : | English |

| File size | : | 225 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 75 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Dan Reingold

Dan Reingold Lauren E Oakes

Lauren E Oakes Steven Levy

Steven Levy Gavin Maxwell

Gavin Maxwell Geoffrey James

Geoffrey James Joan Didion

Joan Didion Diana Estill

Diana Estill Nick Jans

Nick Jans David Asher

David Asher Trevor Moawad

Trevor Moawad Paul Cruickshank

Paul Cruickshank David Denby

David Denby Tom Plate

Tom Plate Susan Higginbotham

Susan Higginbotham Jeffrey W Hayzlett

Jeffrey W Hayzlett Dave Batista

Dave Batista Manuel A Esteban

Manuel A Esteban Jerry Yudelson

Jerry Yudelson Edmund S Morgan

Edmund S Morgan Carl Rollyson

Carl Rollyson

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

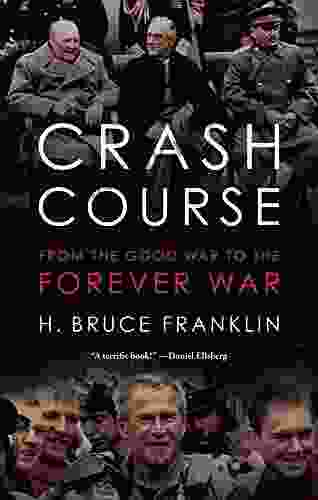

Ernest HemingwayFrom the Good War to the Forever War: The Evolution and Impact of War Culture...

Ernest HemingwayFrom the Good War to the Forever War: The Evolution and Impact of War Culture... Dennis HayesFollow ·13.2k

Dennis HayesFollow ·13.2k Israel BellFollow ·5.5k

Israel BellFollow ·5.5k Christian BarnesFollow ·6.3k

Christian BarnesFollow ·6.3k Edison MitchellFollow ·8.1k

Edison MitchellFollow ·8.1k Galen PowellFollow ·7.4k

Galen PowellFollow ·7.4k Eddie PowellFollow ·17.2k

Eddie PowellFollow ·17.2k Edgar CoxFollow ·16k

Edgar CoxFollow ·16k Herman MitchellFollow ·12.4k

Herman MitchellFollow ·12.4k

Edwin Blair

Edwin BlairKilling A King: The Assassination Of Yitzhak Rabin And...

## The Assassination Of Yitzhak Rabin And The...

Carlos Fuentes

Carlos FuentesDeath in Benin: Where Science Meets Voodoo

In the West African nation of Benin, death...

Ernest J. Gaines

Ernest J. GainesA Comprehensive Guide to Managing Your Girlfriend's White...

White guilt, a complex and...

Jon Reed

Jon ReedThe Notorious Life and Times of Pablo Escobar, the...

Pablo Escobar, the...

Juan Rulfo

Juan RulfoTrainwreck: My Life As An Idiot

My life has been a trainwreck. I've made...

Christian Barnes

Christian BarnesFirst Words Childhood In Fascist Italy: A Haunting Memoir...

First Words Childhood In...

4.2 out of 5

| Language | : | English |

| File size | : | 225 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 75 pages |

| Lending | : | Enabled |