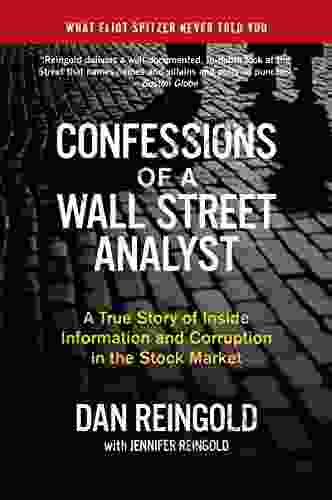

Inside the Decade That Transformed Wall Street

The 1980s were a transformative decade for Wall Street. The rise of junk bonds, leveraged buyouts, and the birth of the modern financial industry forever changed the way that business was done on Wall Street.

4.2 out of 5

| Language | : | English |

| File size | : | 1083 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 272 pages |

| Lending | : | Enabled |

At the beginning of the decade, Wall Street was still reeling from the aftermath of the 1970s oil crisis. The stock market had crashed, and the economy was in recession. But as the decade progressed, a new generation of investors emerged, eager to take advantage of the opportunities that the changing economy presented.

One of the most important figures of the 1980s was Michael Milken. Milken was a junk bond salesman who developed new ways to finance risky businesses. Junk bonds were high-yield, high-risk bonds that were often used to finance leveraged buyouts. Leveraged buyouts were transactions in which a private equity firm would borrow money to buy a company, then sell off its assets to pay down the debt. The 1980s saw a wave of leveraged buyouts, as private equity firms took advantage of the low interest rates and high stock prices of the era.

Another key figure of the 1980s was Ivan Boesky. Boesky was an arbitrageur who made millions of dollars by betting on the outcome of mergers and acquisitions. Boesky's success helped to fuel the merger and acquisition boom of the 1980s.

The 1980s also saw the rise of the modern financial industry. New financial products, such as derivatives and hedge funds, were developed to meet the needs of increasingly sophisticated investors. The financial industry also became more global, as banks and investment firms expanded their operations into new markets.

The decade of the 1980s was a time of great excess and innovation on Wall Street. But it was also a time of great risk. The junk bond market collapsed in 1989, and the stock market crashed in 1987. These events led to a recession and a loss of confidence in the financial industry. However, the 1980s also laid the foundation for the modern financial industry, and the innovations of that era continue to shape the way that business is done on Wall Street today.

The Key Players

The 1980s was a decade of larger-than-life characters on Wall Street. Here are some of the key players who helped to shape the decade:

- Michael Milken: Milken was a junk bond salesman who developed new ways to finance risky businesses. He was one of the most successful and controversial figures of the 1980s.

- Ivan Boesky: Boesky was an arbitrageur who made millions of dollars by betting on the outcome of mergers and acquisitions. He was one of the key figures in the insider trading scandal of the 1980s.

- Henry Kravis and George Roberts: Kravis and Roberts were the founders of Kohlberg Kravis Roberts & Co. (KKR),one of the most successful private equity firms of the 1980s. KKR pioneered the use of leveraged buyouts to acquire companies.

- Carl Icahn: Icahn was a corporate raider who made billions of dollars by taking over undervalued companies and selling off their assets. He was one of the most feared and respected investors of the 1980s.

- John Gutfreund: Gutfreund was the CEO of Salomon Brothers, one of the most prestigious investment banks of the 1980s. He was forced to resign in 1991 after Salomon was involved in a Treasury bond trading scandal.

The Key Events

The 1980s was a decade of major events that transformed Wall Street. Here are some of the key events that shaped the decade:

- The Junk Bond Market Collapse: The junk bond market collapsed in 1989, leading to a recession and a loss of confidence in the financial industry.

- The Stock Market Crash of 1987: The stock market crashed in 1987, losing nearly 23% of its value in a single day. The crash was the largest one-day percentage decline in stock market history.

- The Insider Trading Scandal: The insider trading scandal of the 1980s involved the illegal trading of stocks based on nonpublic information. The scandal led to the imprisonment of several Wall Street executives, including Ivan Boesky and Michael Milken.

- The Rise of the Modern Financial Industry: The 1980s saw the rise of the modern financial industry, with the development of new financial products and the globalization of the financial markets.

- The Birth of the Hedge Fund Industry: The hedge fund industry was born in the 1980s, as investors sought new ways to generate returns in a volatile market.

The Legacy of the 1980s

The 1980s was a decade of great change on Wall Street. The innovations of that era continue to shape the way that business is done on Wall Street today. However, the decade also left a legacy of excess and risk.

The junk bond market collapse and the stock market crash of 1987 showed that the financial markets can be volatile and unpredictable. The insider trading scandal of the 1980s showed that the financial industry is not immune to corruption. And the rise of the modern financial industry has created new risks for investors.

The 1980s was a decade of great transformation on Wall Street. But it was also a decade of lessons learned. The lessons of the 1980s should be remembered as we move forward in the 21st century.

4.2 out of 5

| Language | : | English |

| File size | : | 1083 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 272 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Amanda Brice

Amanda Brice Peter Scott Morgan

Peter Scott Morgan Ryan W Quinn

Ryan W Quinn Randy J Sparks

Randy J Sparks Jim Mellon

Jim Mellon Richard Corman

Richard Corman W Ralph Eubanks

W Ralph Eubanks Nick Jans

Nick Jans David Chrisinger

David Chrisinger Sandra Knauf

Sandra Knauf A J Baime

A J Baime Jen Lancaster

Jen Lancaster Christian Hageseth

Christian Hageseth Ted Genoways

Ted Genoways Otegha Uwagba

Otegha Uwagba Shappi Khorsandi

Shappi Khorsandi Yogesh K Soni

Yogesh K Soni James Whitaker

James Whitaker Michael Shnayerson

Michael Shnayerson Mike Leonard

Mike Leonard

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Clark BellThe Epic Life and Immortal Photographs of Edward Curtis: Capturing the Spirit...

Clark BellThe Epic Life and Immortal Photographs of Edward Curtis: Capturing the Spirit...

Douglas PowellThe Corrosive Impact of Insider Trading and Corruption in the Stock Market: A...

Douglas PowellThe Corrosive Impact of Insider Trading and Corruption in the Stock Market: A... Desmond FosterFollow ·7k

Desmond FosterFollow ·7k William WordsworthFollow ·12.5k

William WordsworthFollow ·12.5k Gage HayesFollow ·4.5k

Gage HayesFollow ·4.5k Benjamin StoneFollow ·2.9k

Benjamin StoneFollow ·2.9k Isaiah PowellFollow ·12.9k

Isaiah PowellFollow ·12.9k Nathaniel PowellFollow ·13.1k

Nathaniel PowellFollow ·13.1k Darren BlairFollow ·13.6k

Darren BlairFollow ·13.6k Hassan CoxFollow ·19.1k

Hassan CoxFollow ·19.1k

Edwin Blair

Edwin BlairKilling A King: The Assassination Of Yitzhak Rabin And...

## The Assassination Of Yitzhak Rabin And The...

Carlos Fuentes

Carlos FuentesDeath in Benin: Where Science Meets Voodoo

In the West African nation of Benin, death...

Ernest J. Gaines

Ernest J. GainesA Comprehensive Guide to Managing Your Girlfriend's White...

White guilt, a complex and...

Jon Reed

Jon ReedThe Notorious Life and Times of Pablo Escobar, the...

Pablo Escobar, the...

Juan Rulfo

Juan RulfoTrainwreck: My Life As An Idiot

My life has been a trainwreck. I've made...

Christian Barnes

Christian BarnesFirst Words Childhood In Fascist Italy: A Haunting Memoir...

First Words Childhood In...

4.2 out of 5

| Language | : | English |

| File size | : | 1083 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 272 pages |

| Lending | : | Enabled |