Unlock Passive Income With Covered Calls: A Comprehensive Guide for Beginners

4.5 out of 5

| Language | : | English |

| File size | : | 3804 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 170 pages |

| Lending | : | Enabled |

In the realm of investing, covered calls stand as a versatile and income-generating strategy that enables you to unlock the potential of your stock holdings. This comprehensive guide will delve deep into the mechanics, benefits, and risks associated with covered calls, empowering you to make informed decisions and maximize your financial gains.

What Are Covered Calls?

A covered call is an options strategy that involves selling (or "writing") a call option against an underlying stock that you already own. The call option grants the buyer the right (but not the obligation) to purchase your stock at a predetermined price (the strike price) on or before a specified date (the expiration date).

Key Terminology

- Premium: The amount of money you receive from the party who buys your call option.

- Strike Price: The price at which the buyer can purchase your stock if they choose to exercise the option.

- Expiration Date: The date on which the option expires and becomes worthless.

- Underlying Stock: The stock that you own and that the call option is written against.

How Covered Calls Work

To execute a covered call, you must first have shares of the underlying stock in your trading account. Once you have identified a suitable stock and strike price, you can sell a call option against it. In return, you receive a premium from the buyer.

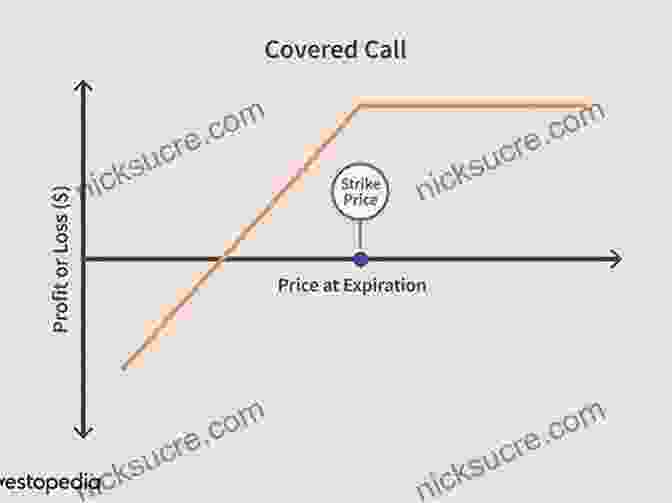

There are two possible outcomes to a covered call:

- **The stock price stays below the strike price.** In this scenario, the option expires worthless, and you keep the premium as income.

- **The stock price rises above the strike price.** The buyer may choose to exercise their option and purchase your stock at the strike price, forcing you to sell your shares at that price, regardless of the current market price.

Benefits of Covered Calls

Covered calls offer several compelling benefits for investors:

- Passive Income: The premium you receive from selling the call option is a source of passive income that can supplement your other revenue streams.

- Limited Risk: Because you are already the owner of the underlying stock, your potential losses are limited to the difference between the stock's purchase price and the strike price of the call option.

- Potential Stock Upside: If the stock price rises significantly, you can still benefit from the appreciation in value, even if the option is exercised.

Risks of Covered Calls

It is important to be aware of the potential risks associated with covered calls:

- Loss of Upside Potential: If the stock price rises significantly, you may miss out on potential gains if the option is exercised.

- Forced Stock Sale: If the stock price rises above the strike price, you are obligated to sell your shares at that price, regardless of their current market value.

- Complexity: Covered calls can be more complex than other investment strategies and require a thorough understanding of options trading.

Choosing the Right Stocks for Covered Calls

To successfully implement covered calls, it is essential to select stocks that meet certain criteria:

- Stable, Dividend-Paying Stocks: These stocks provide a consistent income stream and are less likely to experience significant price swings.

- High Implied Volatility: Implied volatility is a measure of the market's expectation of future price fluctuations. Higher implied volatility means higher premiums for call options.

- Liquid Stocks: Stocks with a high trading volume ensure that your call options will have a ready market for buying and selling.

Managing Covered Calls

Once you have sold a covered call, it is important to manage it effectively:

- Monitor the Stock Price: Track the stock's price daily to make informed decisions about adjusting or closing your position.

- Roll the Call Option: If the stock price rises significantly, you may consider rolling the call option to a higher strike price to capture additional premium.

- Close the Call Option: If the stock price falls or you need immediate access to your shares, you can close the call option by buying it back.

Covered calls can be a powerful tool for income generation and portfolio enhancement, but it is crucial to approach them with a thorough understanding of their mechanics, benefits, and risks. This guide has provided a comprehensive overview of covered calls, empowering you to make informed decisions and navigate the strategy with confidence. Remember to seek guidance from a financial advisor if you are unsure how to incorporate covered calls into your investment strategy.

4.5 out of 5

| Language | : | English |

| File size | : | 3804 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 170 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Salvador Briggman

Salvador Briggman Ali Vincent

Ali Vincent Cameron Blake

Cameron Blake Dawn Drzal

Dawn Drzal Nathaniel Popper

Nathaniel Popper Justin Kerr

Justin Kerr Paola Pugliatti

Paola Pugliatti Jennifer Romolini

Jennifer Romolini Timothy Snyder

Timothy Snyder Charlotte Gray

Charlotte Gray Ian Balina

Ian Balina Simon Winchester

Simon Winchester Wikijob

Wikijob Irenosen Okojie

Irenosen Okojie Neil White

Neil White John W F Dulles

John W F Dulles Andrew Sobel

Andrew Sobel Vilhjalmur Stefansson

Vilhjalmur Stefansson Jack Jones

Jack Jones Diana Nammi

Diana Nammi

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Ted SimmonsPointe of No Return: The Captivating Mystery of Dani Spevak and the Allure of...

Ted SimmonsPointe of No Return: The Captivating Mystery of Dani Spevak and the Allure of...

Holden BellHabari Gani: The Kwanzaa Experience - A Journey Through African Culture and...

Holden BellHabari Gani: The Kwanzaa Experience - A Journey Through African Culture and...

Kurt VonnegutThe Strange Death and Life of Che Guevara: A Legendary Revolutionary's Impact...

Kurt VonnegutThe Strange Death and Life of Che Guevara: A Legendary Revolutionary's Impact... Adam HayesFollow ·18.9k

Adam HayesFollow ·18.9k Dwayne MitchellFollow ·3.9k

Dwayne MitchellFollow ·3.9k Houston PowellFollow ·16.1k

Houston PowellFollow ·16.1k John GrishamFollow ·6.3k

John GrishamFollow ·6.3k Alexandre DumasFollow ·10.4k

Alexandre DumasFollow ·10.4k Harry HayesFollow ·6.9k

Harry HayesFollow ·6.9k Joel MitchellFollow ·15.6k

Joel MitchellFollow ·15.6k Jon ReedFollow ·14k

Jon ReedFollow ·14k

Edwin Blair

Edwin BlairKilling A King: The Assassination Of Yitzhak Rabin And...

## The Assassination Of Yitzhak Rabin And The...

Carlos Fuentes

Carlos FuentesDeath in Benin: Where Science Meets Voodoo

In the West African nation of Benin, death...

Ernest J. Gaines

Ernest J. GainesA Comprehensive Guide to Managing Your Girlfriend's White...

White guilt, a complex and...

Jon Reed

Jon ReedThe Notorious Life and Times of Pablo Escobar, the...

Pablo Escobar, the...

Juan Rulfo

Juan RulfoTrainwreck: My Life As An Idiot

My life has been a trainwreck. I've made...

Christian Barnes

Christian BarnesFirst Words Childhood In Fascist Italy: A Haunting Memoir...

First Words Childhood In...

4.5 out of 5

| Language | : | English |

| File size | : | 3804 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 170 pages |

| Lending | : | Enabled |