Retirement Distribution Strategies For The Non-Conformist: A Comprehensive Guide to Maximizing Your Retirement Income

Are you nearing retirement and looking for alternative ways to maximize your retirement income? This comprehensive guide is for you, the non-conformist investor who is ready to break free from traditional retirement planning strategies.

Traditional Retirement Plans vs. Alternative Investments

For decades, Americans have relied heavily on traditional retirement plans like 401(k)s and IRAs. While these plans offer tax benefits and guaranteed income streams, they can also be restrictive and limiting.

5 out of 5

| Language | : | English |

| File size | : | 2681 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 158 pages |

| Lending | : | Enabled |

Non-conformist investors are exploring alternative investments that offer greater flexibility, diversification, and growth potential. These include:

- Real estate

- Private equity

- Venture capital

- Precious metals

- Cryptocurrency

Tax-Efficient Strategies for Non-Traditional Income

When diversifying your retirement portfolio with alternative investments, tax efficiency is crucial. Here are some strategies to minimize tax liability:

- Roth conversions: Convert a traditional IRA or 401(k) to a Roth account, paying taxes upfront to avoid future withdrawals from being taxed.

- Qualified longevity annuity contracts (QLACs): Purchase an annuity contract that provides guaranteed income after age 85, deferring taxes until retirement.

- Charitable remainder trusts: Donate a portion of your assets to a charity while retaining income for life or a specific period.

- Self-directed IRAs: Invest in alternative assets within an IRA, offering tax-deferred growth potential.

Managing Required Minimum Distributions (RMDs)

Traditional retirement plans require taking required minimum distributions (RMDs) starting at age 72. These forced withdrawals can deplete your savings prematurely and increase your tax burden.

For non-conformist investors, consider these strategies to manage RMDs:

- Roth IRAs: Roth accounts are not subject to RMDs, allowing you to accumulate wealth without forced withdrawals.

- Inherited IRAs: Spouses and non-spouse beneficiaries can inherit an IRA and stretch out RMDs over a longer period.

- Charitable gifts: Donate up to $100,000 directly from your IRA to charity without triggering an RMD.

Estate Planning for Non-Traditional Assets

As you accumulate non-traditional assets in retirement, estate planning becomes increasingly important. Here are some considerations:

- Revocable living trusts: Avoid probate and manage your assets during your lifetime and after death.

- Appointing a successor trustee: Choose a trusted individual to manage your trust should you become incapacitated.

- Creating a will: Specify how your non-traditional assets should be distributed after your death.

For the non-conformist investor, retirement distribution strategies go beyond traditional plans. By exploring alternative investments, implementing tax-efficient strategies, and planning for estate distribution, you can maximize your retirement income and achieve financial independence on your own terms.

Remember, this guide is for informational purposes only and does not constitute financial advice. Consult with a qualified financial professional to develop a personalized retirement distribution strategy that meets your unique needs and circumstances.

5 out of 5

| Language | : | English |

| File size | : | 2681 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 158 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Joseph Frank

Joseph Frank Yogesh K Soni

Yogesh K Soni Flavius Josephus

Flavius Josephus Pamela Newkirk

Pamela Newkirk Mark Baldassare

Mark Baldassare Stephen Richard Witt

Stephen Richard Witt Lynne Porter

Lynne Porter Johnette Van Eeden

Johnette Van Eeden Paul J Nahin

Paul J Nahin H W Brands

H W Brands Molly O Neill

Molly O Neill Shashi Tharoor

Shashi Tharoor Andrew M Campbell

Andrew M Campbell Norbert Gaillard

Norbert Gaillard Henry M Robert

Henry M Robert Kerry London

Kerry London Terry Barkley

Terry Barkley Anjan Sundaram

Anjan Sundaram Grace Bowman

Grace Bowman Derek Jacobi

Derek Jacobi

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

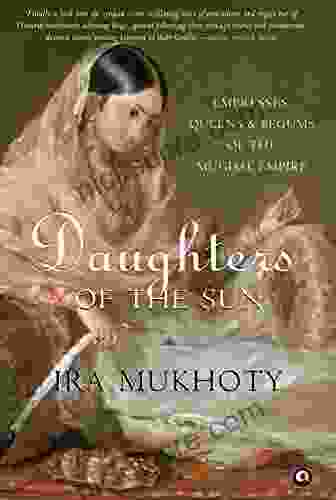

Cristian CoxThe Queens, Empresses, and Begums: Unraveling the Enchanting Lives of Mughal...

Cristian CoxThe Queens, Empresses, and Begums: Unraveling the Enchanting Lives of Mughal... Brandon CoxFollow ·8.4k

Brandon CoxFollow ·8.4k Mike HayesFollow ·18.9k

Mike HayesFollow ·18.9k Edgar Allan PoeFollow ·12k

Edgar Allan PoeFollow ·12k H.G. WellsFollow ·16.1k

H.G. WellsFollow ·16.1k Vernon BlairFollow ·10.5k

Vernon BlairFollow ·10.5k Benji PowellFollow ·12.8k

Benji PowellFollow ·12.8k Edward BellFollow ·8k

Edward BellFollow ·8k Jake PowellFollow ·2.7k

Jake PowellFollow ·2.7k

Edwin Blair

Edwin BlairKilling A King: The Assassination Of Yitzhak Rabin And...

## The Assassination Of Yitzhak Rabin And The...

Carlos Fuentes

Carlos FuentesDeath in Benin: Where Science Meets Voodoo

In the West African nation of Benin, death...

Ernest J. Gaines

Ernest J. GainesA Comprehensive Guide to Managing Your Girlfriend's White...

White guilt, a complex and...

Jon Reed

Jon ReedThe Notorious Life and Times of Pablo Escobar, the...

Pablo Escobar, the...

Juan Rulfo

Juan RulfoTrainwreck: My Life As An Idiot

My life has been a trainwreck. I've made...

Christian Barnes

Christian BarnesFirst Words Childhood In Fascist Italy: A Haunting Memoir...

First Words Childhood In...

5 out of 5

| Language | : | English |

| File size | : | 2681 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 158 pages |

| Lending | : | Enabled |