Unveiling the Secrets of Ireland's Tax Haven: An In-Depth Look into Kieran Allen's Tax Avoidance Schemes

In the realm of international tax law, Ireland has emerged as a prominent player, attracting multinational corporations with its alluring tax incentives. However, the country's reputation as a tax haven has come under scrutiny due to the controversial tax avoidance strategies employed by some corporations, facilitated by the mastermind behind many of these schemes: Kieran Allen. This article delves into the intricate world of Irish tax havens, examining the methods, controversies, and consequences surrounding Allen's tax avoidance schemes.

5 out of 5

| Language | : | English |

| File size | : | 1424 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 271 pages |

The Rise of Ireland's Tax Haven

Ireland's transformation into a tax haven began in the 1990s, driven by the government's desire to attract foreign investment and stimulate economic growth. The of a 12.5% corporate tax rate, significantly lower than the prevailing rates in other developed countries, proved to be a potent magnet for multinational corporations seeking to reduce their tax liabilities.

Kieran Allen: The Man Behind the Schemes

Kieran Allen, a Dublin-based tax consultant, emerged as a central figure in Ireland's tax haven industry. Known for his innovative tax avoidance strategies, Allen played a pivotal role in designing and implementing complex tax structures that allowed multinational corporations to minimize their global tax burden.

The Double Irish and the Malta Sandwich

Among Allen's most famous tax avoidance schemes are the "Double Irish" and the "Malta Sandwich." The Double Irish involved establishing two Irish subsidiaries, one resident in Ireland and the other in a low-tax jurisdiction. The Irish subsidiary would license intellectual property to the non-resident subsidiary, which would then pay royalties back to the Irish parent company, effectively shielding the income from higher taxes elsewhere.

The Malta Sandwich, a more complex structure, involved a Maltese company interposed between the Irish parent company and the non-resident subsidiary. The Maltese company, benefiting from Malta's favorable tax treaty with Ireland, would receive royalties from the non-resident subsidiary and pay dividends to the Irish parent company, further reducing the overall tax liability.

Controversies and Criticism

Allen's tax avoidance schemes have sparked widespread controversy and criticism. Detractors argue that these schemes exploit loopholes in tax laws, depriving governments of much-needed tax revenue. They contend that allowing multinational corporations to minimize their tax obligations undermines the fairness and integrity of the international tax system.

International Pressure and Anti-Avoidance Measures

The widespread use of tax havens and tax avoidance strategies like those employed by Allen drew the attention of international organizations such as the OECD (Organization for Economic Cooperation and Development). In response, the OECD developed the BEPS (Base Erosion and Profit Shifting) initiative, a comprehensive set of anti-avoidance measures designed to combat tax avoidance practices.

Consequences and Reforms

The international pressure and scrutiny forced Ireland to re-evaluate its tax policies. The Irish government introduced several reforms, including the abolition of the Double Irish structure and the tightening of tax loopholes. However, Ireland still remains an attractive location for multinational corporations due to its relatively low corporate tax rate and its extensive network of tax treaties.

Ireland's tax haven status has been shaped by the ingenuity of tax consultants like Kieran Allen, who devised intricate tax avoidance schemes that exploited loopholes in international tax laws. While these schemes have allowed multinational corporations to minimize their tax liabilities, they have also sparked controversies and prompted international efforts to combat tax avoidance. Ireland has implemented reforms in response to international pressure, but the country continues to navigate the complex world of international tax law, balancing its economic interests with the need for fairness and transparency.

5 out of 5

| Language | : | English |

| File size | : | 1424 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 271 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Edward Kanze

Edward Kanze Chelsea Handler

Chelsea Handler Daniel Gordis

Daniel Gordis Sir Peter Hall

Sir Peter Hall Thomas Taylor

Thomas Taylor James Edmonds

James Edmonds Glenn Deir

Glenn Deir James Rosen

James Rosen Jeffrey D Sachs

Jeffrey D Sachs Luke Dormehl

Luke Dormehl Sezai Coban

Sezai Coban Judy Wicks

Judy Wicks Stephen Hawley Martin

Stephen Hawley Martin Priscilla Stuckey

Priscilla Stuckey Andy Core

Andy Core Sigrid Undset

Sigrid Undset Arthur W Bloom

Arthur W Bloom David Tsubouchi

David Tsubouchi Jonathan Levy

Jonathan Levy Owen West

Owen West

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

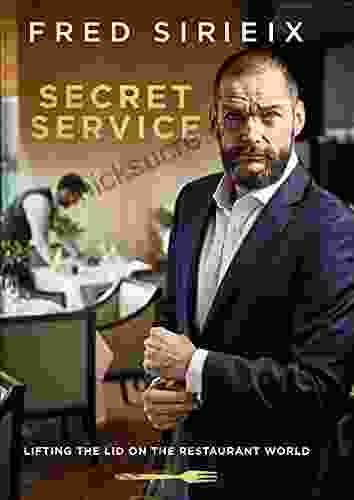

D'Angelo CarterLifting the Lid on the Restaurant World: An Insider's Perspective on the...

D'Angelo CarterLifting the Lid on the Restaurant World: An Insider's Perspective on the... Lawrence BellFollow ·17.6k

Lawrence BellFollow ·17.6k Owen SimmonsFollow ·11.9k

Owen SimmonsFollow ·11.9k Albert CamusFollow ·14.6k

Albert CamusFollow ·14.6k Jett PowellFollow ·14.1k

Jett PowellFollow ·14.1k Luke BlairFollow ·9.7k

Luke BlairFollow ·9.7k Marcus BellFollow ·19.7k

Marcus BellFollow ·19.7k Harold BlairFollow ·3.1k

Harold BlairFollow ·3.1k Ralph TurnerFollow ·5.4k

Ralph TurnerFollow ·5.4k

Edwin Blair

Edwin BlairKilling A King: The Assassination Of Yitzhak Rabin And...

## The Assassination Of Yitzhak Rabin And The...

Carlos Fuentes

Carlos FuentesDeath in Benin: Where Science Meets Voodoo

In the West African nation of Benin, death...

Ernest J. Gaines

Ernest J. GainesA Comprehensive Guide to Managing Your Girlfriend's White...

White guilt, a complex and...

Jon Reed

Jon ReedThe Notorious Life and Times of Pablo Escobar, the...

Pablo Escobar, the...

Juan Rulfo

Juan RulfoTrainwreck: My Life As An Idiot

My life has been a trainwreck. I've made...

Christian Barnes

Christian BarnesFirst Words Childhood In Fascist Italy: A Haunting Memoir...

First Words Childhood In...

5 out of 5

| Language | : | English |

| File size | : | 1424 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 271 pages |