Empower Your Financial Future: The Comprehensive Guide to Repairing Your Credit Score

Your credit score serves as a crucial indicator of your financial health. It influences everything from loan approvals to insurance rates and even employment opportunities. A damaged credit score can create a ripple effect, hindering your ability to achieve financial stability and success. However, repairing your credit score is not an impossible feat. With the right knowledge, strategies, and determination, you can reclaim your financial standing.

Before embarking on the credit repair journey, it's essential to grasp the factors that contribute to your credit score. These include:

- Payment History (35%): Timely bill payments are paramount. Late or missed payments significantly impact your score.

- Amounts Owed (30%): The amount of outstanding debt relative to your available credit (utilization ratio) affects your score. Keep your credit utilization ratio below 30%.

- Length of Credit History (15%): A longer credit history with a consistent track record enhances your score.

- New Credit (10%): Avoid opening numerous new credit accounts in a short period, as this can raise red flags.

- Credit Mix (10%): A mix of different types of credit, such as credit cards, installment loans, and mortgages, can improve your score.

A damaged credit score can have far-reaching consequences:

5 out of 5

| Language | : | English |

| File size | : | 504 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 75 pages |

| Lending | : | Enabled |

- Higher Interest Rates: Lenders perceive individuals with poor credit scores as riskier borrowers and charge higher interest rates accordingly.

- Denied Loans and Credit Cards: A low credit score can make it challenging to qualify for loans or credit cards, limiting your financial options.

- Job Discrimination: Some employers use credit scores to assess job candidates, and a poor score can hinder employment prospects.

- Increased Insurance Premiums: Insurance companies may charge higher premiums to individuals with low credit scores, resulting in increased financial burden.

Repairing your credit score requires a multi-pronged approach. Here's a step-by-step guide:

- Obtain Your Credit Reports: Request free credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. Review them carefully for any errors or inaccuracies.

- Dispute Errors: If you find any incorrect information on your credit reports, file a dispute with the credit bureau. Provide supporting documentation to substantiate your claim.

- Pay Down Debt: Make timely payments on all your debts, starting with those with the highest interest rates. Focus on reducing your overall credit utilization ratio.

- Avoid New Credit: Limit opening new credit accounts. If you do need to borrow, opt for a secured loan or credit-builder loan that reports to credit bureaus.

- Build Positive Credit History: Become an authorized user on someone else's credit card or apply for a secured credit card to establish a payment track record.

- Seek Professional Help: Consider consulting with a non-profit credit counseling agency for guidance and support. They can provide personalized advice and assist with debt management.

- Monitor Your Credit Regularly: Track your credit score and credit reports to stay aware of your financial health.

- Educate Yourself: Enhance your financial literacy by reading books, attending workshops, or seeking guidance from financial professionals.

- Stay Patient and Persistent: Credit repair is a journey that requires patience and persistence. Don't get discouraged if you don't see immediate results.

Repairing your credit score is an empowering process that can unlock a brighter financial future. By understanding the factors that affect your score, disputing errors, paying down debt, and building positive credit history, you can gradually restore your financial standing. Remember, it takes time and effort, but the rewards of financial freedom are well worth the perseverance. Equip yourself with the knowledge and strategies outlined in this guide, and embark on the path to credit score success.

5 out of 5

| Language | : | English |

| File size | : | 504 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 75 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Steven V Roberts

Steven V Roberts R R Palmer

R R Palmer Marty Neumeier

Marty Neumeier Verne Harnish

Verne Harnish Tracy Borman

Tracy Borman John F Wasik

John F Wasik Philip Haslam

Philip Haslam Jayne Seminare Docherty

Jayne Seminare Docherty Kara Goldin

Kara Goldin Dana Adams Schmidt

Dana Adams Schmidt Kyra E Hicks

Kyra E Hicks Bertolt Brecht

Bertolt Brecht John James Santangelo Phd

John James Santangelo Phd 2014th Edition Kindle Edition

2014th Edition Kindle Edition Gray Cook

Gray Cook Keith Johnstone

Keith Johnstone Michael Lind

Michael Lind Tanja Aebischer

Tanja Aebischer Cathy Haase

Cathy Haase Anelia Schutte

Anelia Schutte

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

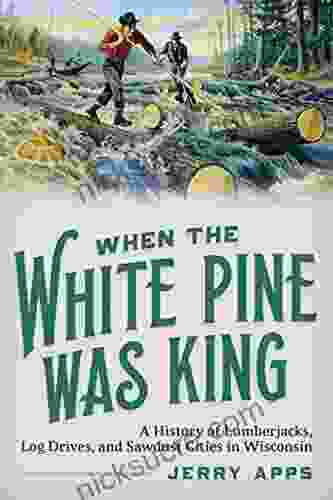

Tony CarterWhen the White Pine Was King: The Rise and Fall of the Lumber Industry in the...

Tony CarterWhen the White Pine Was King: The Rise and Fall of the Lumber Industry in the...

Dustin RichardsonAmerican Women War Correspondents: Unveiling the Untold Stories of World War...

Dustin RichardsonAmerican Women War Correspondents: Unveiling the Untold Stories of World War... Jeffrey CoxFollow ·12.8k

Jeffrey CoxFollow ·12.8k Mitch FosterFollow ·17.8k

Mitch FosterFollow ·17.8k David BaldacciFollow ·7.4k

David BaldacciFollow ·7.4k Branson CarterFollow ·12.5k

Branson CarterFollow ·12.5k Darrell PowellFollow ·17.8k

Darrell PowellFollow ·17.8k Mario Vargas LlosaFollow ·6.1k

Mario Vargas LlosaFollow ·6.1k Corey HayesFollow ·7.3k

Corey HayesFollow ·7.3k Derek BellFollow ·11.8k

Derek BellFollow ·11.8k

Edwin Blair

Edwin BlairKilling A King: The Assassination Of Yitzhak Rabin And...

## The Assassination Of Yitzhak Rabin And The...

Carlos Fuentes

Carlos FuentesDeath in Benin: Where Science Meets Voodoo

In the West African nation of Benin, death...

Ernest J. Gaines

Ernest J. GainesA Comprehensive Guide to Managing Your Girlfriend's White...

White guilt, a complex and...

Jon Reed

Jon ReedThe Notorious Life and Times of Pablo Escobar, the...

Pablo Escobar, the...

Juan Rulfo

Juan RulfoTrainwreck: My Life As An Idiot

My life has been a trainwreck. I've made...

Christian Barnes

Christian BarnesFirst Words Childhood In Fascist Italy: A Haunting Memoir...

First Words Childhood In...

5 out of 5

| Language | : | English |

| File size | : | 504 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 75 pages |

| Lending | : | Enabled |