Building Your Warehouse of Wealth: A Comprehensive Guide to Financial Success

In the pursuit of financial freedom and abundance, building a warehouse of wealth is an aspiration shared by many. However, accumulating substantial wealth requires a strategic and multifaceted approach that involves understanding key principles, adopting prudent practices, and leveraging proven strategies. This article serves as a comprehensive guide to guide you on the path towards building your own warehouse of wealth.

1. Establishing a Strong Financial Foundation

Laying a solid financial foundation is the cornerstone of building wealth. This involves developing a clear understanding of your financial situation, including your income, expenses, assets, and debts. Creating a detailed budget that tracks your cash flow and identifies areas for optimization is crucial. Additionally, establishing an emergency fund to cover unexpected expenses provides a safety net and protects your financial stability.

2. Investing in Your Human Capital

Your human capital, or the knowledge, skills, and abilities you possess, is a valuable asset. Continuously investing in your education, training, and personal growth increases your earning potential and enhances your ability to generate wealth. Pursuing higher education, obtaining professional certifications, and attending workshops and conferences are all effective ways to enhance your human capital.

4.6 out of 5

| Language | : | English |

| File size | : | 688 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 120 pages |

| Lending | : | Enabled |

3. Automating Your Finances

Automating your finances simplifies and streamlines the process of saving and investing. Setting up automatic transfers from your checking account to a savings or investment account ensures consistent contributions regardless of your income fluctuations. Additionally, automating bill payments eliminates late fees and protects your credit score.

4. Maximizing Tax Advantages

Leveraging tax-advantaged accounts such as 401(k)s, IRAs, and 529 plans can significantly reduce your tax liability while accelerating your wealth accumulation. These accounts offer tax deductions or tax-deferred growth, allowing your investments to compound more effectively. Consulting with a financial advisor can help you determine the most suitable tax-advantaged accounts for your situation.

5. Diversifying Your Portfolio

Diversification is a risk management strategy that involves spreading your investments across different asset classes, industries, and geographic regions. This reduces the overall risk of your portfolio and ensures that your wealth is not overly concentrated in any one particular area. Stocks, bonds, real estate, commodities, and alternative investments are all asset classes that can be included in a diversified portfolio.

6. Investing in Real Estate

Real estate has been a time-tested wealth-building strategy for generations. Investing in properties such as residential homes, apartments, and commercial buildings can generate rental income, capital appreciation, and tax benefits. However, it's important to approach real estate investing with a long-term mindset and conduct thorough research before making any purchases.

7. Building a Passive Income Stream

Passive income refers to income generated without actively working. Creating multiple streams of passive income can significantly enhance your financial security and provide a foundation for long-term wealth accumulation. Examples of passive income include rental properties, dividends, interest from bonds, and royalties from intellectual property.

8. Continuously Monitoring and Adapting

The financial landscape is constantly evolving, making it essential to continuously monitor your investments and adjust your strategy as needed. Regularly reviewing your portfolio's performance, rebalancing asset allocations, and staying up-to-date on market trends are all important aspects of maintaining your wealth. Consulting with a financial advisor can provide valuable insights and guidance in making informed decisions.

9. Practicing Fiscal Discipline

Fiscal discipline involves controlling your spending, avoiding unnecessary debt, and living below your means. While it may involve some sacrifices, practicing fiscal discipline allows you to accumulate wealth more quickly and enhances your overall financial well-being. Creating a realistic budget, limiting discretionary expenses, and exploring cost-effective alternatives can help you maintain fiscal discipline.

10. Embracing a Growth Mindset

Developing a growth mindset is essential for ongoing financial success. This involves embracing a continuous learning attitude, seeking new challenges, and never being satisfied with your current level of knowledge or wealth. By challenging yourself to grow both personally and financially, you open up new opportunities and expand your earning potential.

:

Building a warehouse of wealth is a journey that requires a multifaceted approach, strategic planning, and a commitment to financial discipline. By establishing a strong financial foundation, investing in yourself, automating your finances, maximizing tax advantages, diversifying your portfolio, and embracing a growth mindset, you can lay the groundwork for long-term financial success. Remember that the process requires patience, perseverance, and a willingness to adapt as the financial landscape evolves. By following the principles outlined in this guide, you can build a warehouse of wealth that provides financial security, freedom, and the ability to live a life on your own terms.

4.6 out of 5

| Language | : | English |

| File size | : | 688 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 120 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Mark Sochan

Mark Sochan Andrew Johnson

Andrew Johnson Mary Giuliani

Mary Giuliani Chris Malburg

Chris Malburg Cyrus Ryan

Cyrus Ryan Lev Menand

Lev Menand Hillel Halkin

Hillel Halkin Georgeanne Brennan

Georgeanne Brennan May Sarton

May Sarton Con Coughlin

Con Coughlin Gregrhi Arawn Love

Gregrhi Arawn Love Christopher Everette Cenac

Christopher Everette Cenac Marshall Goldsmith

Marshall Goldsmith Matthew Dixon

Matthew Dixon Ardi Aaziznia

Ardi Aaziznia Rebecca Friedrichs

Rebecca Friedrichs Conrad Kain

Conrad Kain Tom Miller

Tom Miller Colin Boocock

Colin Boocock Robert Kimber

Robert Kimber

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

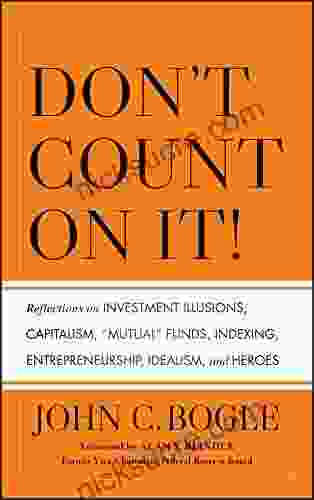

Junot DíazReflections On Investment Illusions: Capitalism, Mutual Funds, Indexing, and...

Junot DíazReflections On Investment Illusions: Capitalism, Mutual Funds, Indexing, and... Stephen FosterFollow ·4.8k

Stephen FosterFollow ·4.8k Natsume SōsekiFollow ·14.5k

Natsume SōsekiFollow ·14.5k George HayesFollow ·17.2k

George HayesFollow ·17.2k Alec HayesFollow ·8.3k

Alec HayesFollow ·8.3k Milan KunderaFollow ·15.4k

Milan KunderaFollow ·15.4k Chance FosterFollow ·12.3k

Chance FosterFollow ·12.3k Shawn ReedFollow ·2.6k

Shawn ReedFollow ·2.6k Ross NelsonFollow ·13k

Ross NelsonFollow ·13k

Edwin Blair

Edwin BlairKilling A King: The Assassination Of Yitzhak Rabin And...

## The Assassination Of Yitzhak Rabin And The...

Carlos Fuentes

Carlos FuentesDeath in Benin: Where Science Meets Voodoo

In the West African nation of Benin, death...

Ernest J. Gaines

Ernest J. GainesA Comprehensive Guide to Managing Your Girlfriend's White...

White guilt, a complex and...

Jon Reed

Jon ReedThe Notorious Life and Times of Pablo Escobar, the...

Pablo Escobar, the...

Juan Rulfo

Juan RulfoTrainwreck: My Life As An Idiot

My life has been a trainwreck. I've made...

Christian Barnes

Christian BarnesFirst Words Childhood In Fascist Italy: A Haunting Memoir...

First Words Childhood In...

4.6 out of 5

| Language | : | English |

| File size | : | 688 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 120 pages |

| Lending | : | Enabled |