Stocks That Return 100% or More: How to Find Them, Invest, and Profit

In the world of stock market investing, the allure of stocks that return 100% or more is irresistible. The prospect of doubling your investment in a short period of time is tantalizing, but it's important to remember that investing is not a get-rich-quick scheme. However, with the right strategies, knowledge, and a bit of luck, it is possible to identify stocks with the potential for triple-digit returns.

4.6 out of 5

| Language | : | English |

| File size | : | 9451 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 226 pages |

| Lending | : | Enabled |

In this comprehensive guide, we will delve into the world of high-growth stocks and provide you with the tools and techniques you need to find, invest in, and profit from them. We will cover everything from fundamental and technical analysis to risk assessment and portfolio management.

Chapter 1: Understanding High-Growth Stocks

Before we start discussing how to find stocks that return 100% or more, let's first define what we mean by "high-growth stocks." These are stocks of companies that are expected to experience rapid growth in their earnings and revenue. The growth potential can be attributed to a variety of factors, such as:

- Innovative products or services

- Expanding into new markets

- Acquiring other companies

- Strong management team

High-growth stocks are often found in emerging industries or sectors that are experiencing rapid technological advancement. However, it's important to note that not all high-growth stocks are created equal. Some companies may have unsustainable growth rates or face significant competition. Therefore, it's crucial to thoroughly research and analyze a company before investing in its stock.

Chapter 2: Strategies for Finding High-Growth Stocks

There are several strategies you can use to find high-growth stocks with the potential for triple-digit returns. Some of the most effective methods include:

Fundamental Analysis

Fundamental analysis involves studying a company's financial statements, management team, and industry to assess its intrinsic value. The goal is to identify companies with strong fundamentals, such as:

- High profit margins

- Strong cash flow

- Low debt

- Experienced management team

By analyzing these factors, you can get a better understanding of a company's financial health and its potential for future growth.

Technical Analysis

Technical analysis involves studying price charts and patterns to predict future price movements. Technical analysts believe that past price movements can provide insights into future trends. Some of the most common technical indicators include:

- Moving averages

- Support and resistance levels

- Chart patterns

- Relative strength index (RSI)

While technical analysis can be a useful tool for identifying potential trading opportunities, it's important to remember that it is not an exact science and should be used in conjunction with fundamental analysis.

Growth at a Reasonable Price (GARP)

The GARP strategy involves finding companies with high growth potential that are trading at a reasonable price. The goal is to identify companies that are growing rapidly but are not yet fully valued by the market. To implement this strategy, you can look for companies with:

- High earnings per share (EPS) growth rates

- Low price-to-earnings (P/E) ratios

- Strong balance sheets

- Favorable industry outlook

GARP stocks can provide a balance between growth and value, making them a good option for investors seeking long-term capital appreciation.

Chapter 3: Investing in High-Growth Stocks

Once you have identified a few high-growth stocks with the potential for triple-digit returns, it's time to invest. Here are some important considerations to keep in mind:

Diversification

Diversification is one of the most important principles of investing. It involves spreading your money across a variety of stocks to reduce risk. When investing in high-growth stocks, it's especially important to diversify because these stocks can be more volatile than others.

You can diversify your portfolio by investing in:

- Stocks in different industries

- Stocks of companies of different sizes

- Stocks of companies in different geographic regions

Risk Tolerance

Before investing in high-growth stocks, it's important to assess your risk tolerance. High-growth stocks can be more volatile than other types of stocks, so it's important to make sure you are comfortable with the level of risk involved. Consider your investment goals, time horizon, and financial situation before making any investment decisions.

Investment Horizon

High-growth stocks typically require a longer investment horizon than other types of stocks. This is because these stocks can be more volatile in the short term, and it may take time for them to reach their full potential. Therefore, it's important to be patient when investing in high-growth stocks and to avoid selling them if the price fluctuates.

Chapter 4: Profiting from High-Growth Stocks

The ultimate goal of investing in high-growth stocks is to profit from them. Here are some strategies for maximizing your profits:

Sell Limits

Sell limits are orders that you can place with your broker to sell a stock at a specific price. This can help you lock in profits if the stock price rises above your target price.

Stop Losses

Stop losses are orders that you can place with your broker to sell a stock if the price falls below a certain level. This can help you limit your losses if the stock price declines.

Trailing Stop Losses

Trailing stop losses are orders that you can place with your broker to sell a stock if the price falls below a certain percentage of the current price. This can help you protect your profits and allow the stock to continue growing if the price continues to rise.

Investing in stocks that return 100% or more is not a get-rich-quick scheme. It requires patience, research, and a well-diversified portfolio. By following the strategies outlined in this guide, you can increase your chances of finding and profiting from these high-growth stocks.

Remember, investing always involves risk, so it's important to invest only what you can afford to lose and to do your own research before making any investment decisions.

4.6 out of 5

| Language | : | English |

| File size | : | 9451 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 226 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare J P Clarke

J P Clarke Gregory Berkhouse

Gregory Berkhouse Dirk Hayhurst

Dirk Hayhurst Tina Brown

Tina Brown Scott S Powell

Scott S Powell Michael Robinson

Michael Robinson Wendy Laura Belcher

Wendy Laura Belcher Ronald M Shapiro

Ronald M Shapiro Richard Selzer

Richard Selzer Manuel A Esteban

Manuel A Esteban Mikel Mangold

Mikel Mangold Marc J Epstein

Marc J Epstein David Tsubouchi

David Tsubouchi Jennifer Bleam

Jennifer Bleam Robert H Frank

Robert H Frank Yuen Yuen Ang

Yuen Yuen Ang George Reisman

George Reisman Peter Longerich

Peter Longerich Mordechai Bar On

Mordechai Bar On Naushad Forbes

Naushad Forbes

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

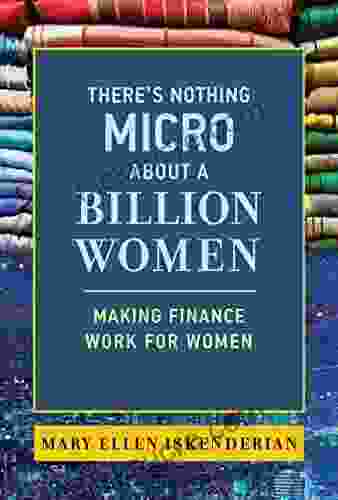

Gabriel MistralThere's Nothing Micro About a Billion Women: Exploring the Growing Influence...

Gabriel MistralThere's Nothing Micro About a Billion Women: Exploring the Growing Influence... Junot DíazFollow ·19.3k

Junot DíazFollow ·19.3k Jan MitchellFollow ·10.3k

Jan MitchellFollow ·10.3k Rex HayesFollow ·5.2k

Rex HayesFollow ·5.2k Efrain PowellFollow ·3.3k

Efrain PowellFollow ·3.3k Aldous HuxleyFollow ·6.2k

Aldous HuxleyFollow ·6.2k Devon MitchellFollow ·9.2k

Devon MitchellFollow ·9.2k Elton HayesFollow ·9.5k

Elton HayesFollow ·9.5k Edgar HayesFollow ·10k

Edgar HayesFollow ·10k

Edwin Blair

Edwin BlairKilling A King: The Assassination Of Yitzhak Rabin And...

## The Assassination Of Yitzhak Rabin And The...

Carlos Fuentes

Carlos FuentesDeath in Benin: Where Science Meets Voodoo

In the West African nation of Benin, death...

Ernest J. Gaines

Ernest J. GainesA Comprehensive Guide to Managing Your Girlfriend's White...

White guilt, a complex and...

Jon Reed

Jon ReedThe Notorious Life and Times of Pablo Escobar, the...

Pablo Escobar, the...

Juan Rulfo

Juan RulfoTrainwreck: My Life As An Idiot

My life has been a trainwreck. I've made...

Christian Barnes

Christian BarnesFirst Words Childhood In Fascist Italy: A Haunting Memoir...

First Words Childhood In...

4.6 out of 5

| Language | : | English |

| File size | : | 9451 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 226 pages |

| Lending | : | Enabled |